The markets have a knack of speaking truth to power. When politicians make promises they’ll struggle to keep, bond traders make them pay the price. When investors see spending rising faster than revenues, they judge that governments are living beyond their means and will have to raise taxes, increase debt or both. Government debt looks riskier, the cost of borrowing goes up. In the charming parlance of the trading floor, this is known as the “moron premium”.

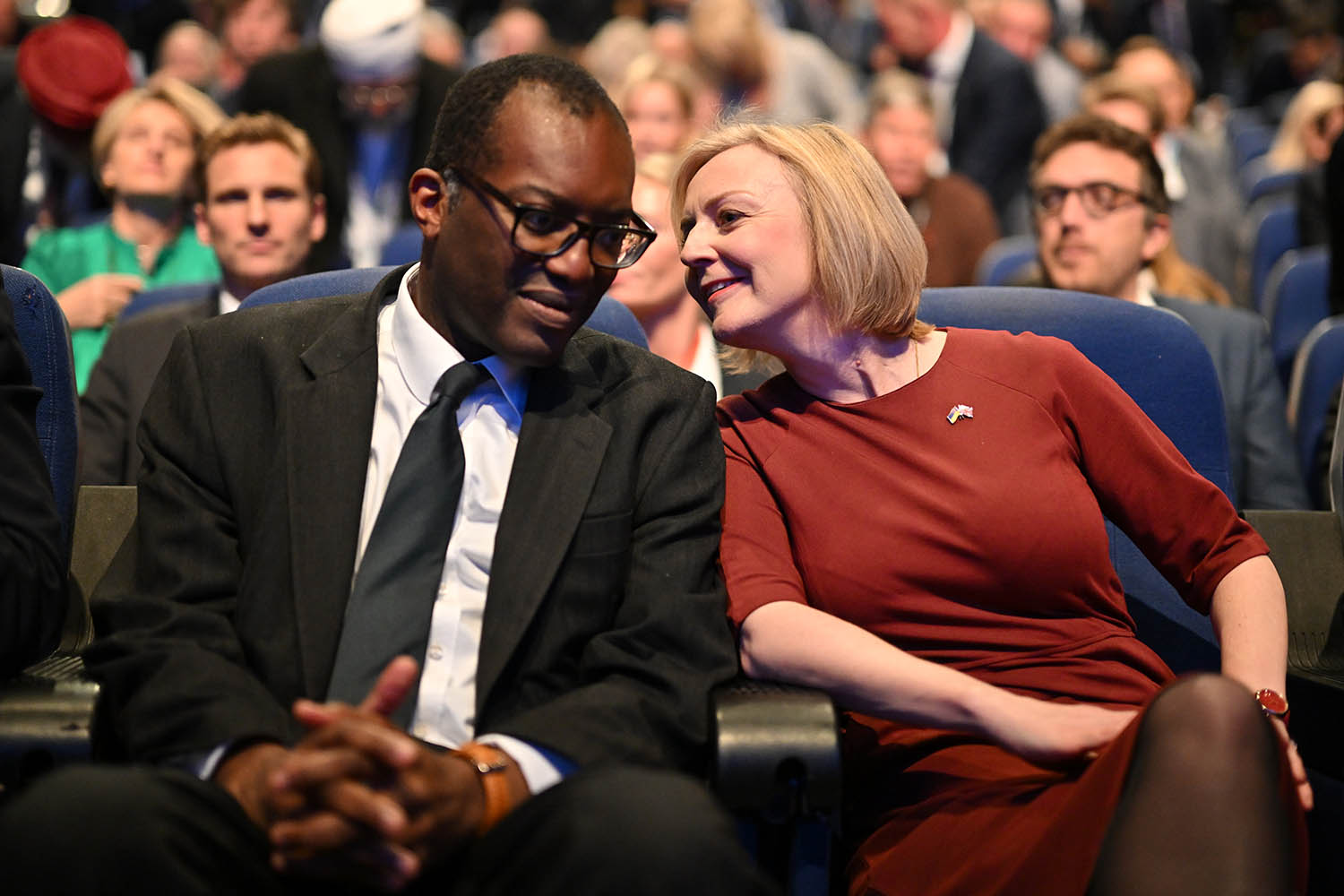

Britain paid the moron premium when Liz Truss briefly ran the country. The combination of £45bn in unfunded tax cuts and unproven plans for growth drew a swift response from the bond markets: the UK’s long-term borrowing costs jumped to a level not seen in nearly 30 years, higher than the cost of borrowing in Italy. For the government, the Truss mini-budget added £10bn in additional debt service costs, according to the Resolution Foundation; for millions of homeowners, it led to higher costs of every sort of borrowing, including mortgages and credit cards.

With an arrogance spiced with victimhood and delusion, Truss has recently gone on to blame everyone but herself. The Bank of England, the Office for Budget Responsibility, the Financial Times, the Davos elite, Joe Biden – they all get a kicking. The markets may see her as a moron, she suggests she’s a lone voice of truth, an economic Messiah: “Just as they’ve tried to do with Trump,” she wrote in the Washington Post last month, “the naysayers pointed to short-term market reactions to bully policymakers out of securing long-term economic prosperity.”

Much like Truss, Donald Trump is now making the American people pay the moron premium. His “liberation day” of global tariff announcements cut trade volumes, raised import prices, spooked ratings agencies (Moody’s downgraded US debt from the top level for the first time ever) and started a bond-holders’ revolt. Trump’s “big beautiful budget bill” has compounded the problem. It will add nearly $4tn to the $36tn national debt at a time when America’s creditors are anxious and its cost of capital is already high. The US is spending more on debt interest than defencefor the first time in its history. Mortgage-holders are feeling it, and will go on doing so: most US home loans are fixed for 30 years.

But the biggest moron premium, relative to the size of the economy, would be paid in Britain under a Nigel Farage government if he stuck to current plans. These are: to nearly double the tax-free allowance to £20,000 at a cost of at least £56bn; to abolish inheritance tax on estates worth less than £2m; and to ape Labour’s rethink on welfare by ending the two-child benefit cap and bringing back the winter fuel allowance. Farage says he would pay for this by scrapping net zero goals, diversity requirements and support for asylum seekers, and cutting government waste.

Related articles:

Putting aside the fact that investing in the green energy transition is essential, that enabling fairness and opportunity is necessary and that demonising immigration is damaging, the sums don’t remotely add up. It’s like paying for a wedding with the church collection.

It’s tempting to ignore the fantasy economics on the populist right. There is such a brisk trade in misinformation and posturing, so why take them seriously, when they’re just offering sound bites? However, it’s too risky to brush off Reform’s policy statements as canny political positioning but not economic promises. As Truss and Trump have shown, delusions are expensive. The markets exact a price for economic idiocy and it’s paid by all of us.

Photo by Leon Neal/Getty Images